BOME AI / BOOK OF MEME (BOME)

Stock market information for BOOK OF MEME (BOME)

- BOOK OF MEME is a crypto in the CRYPTO market.

- The price is 0.00201092 USD currently with a change of -0.00 USD (-0.02%) from the previous close.

- The intraday high is 0.00211397 USD and the intraday low is 0.00192033 USD.

1. ⚙️ Overview & Price Snapshot

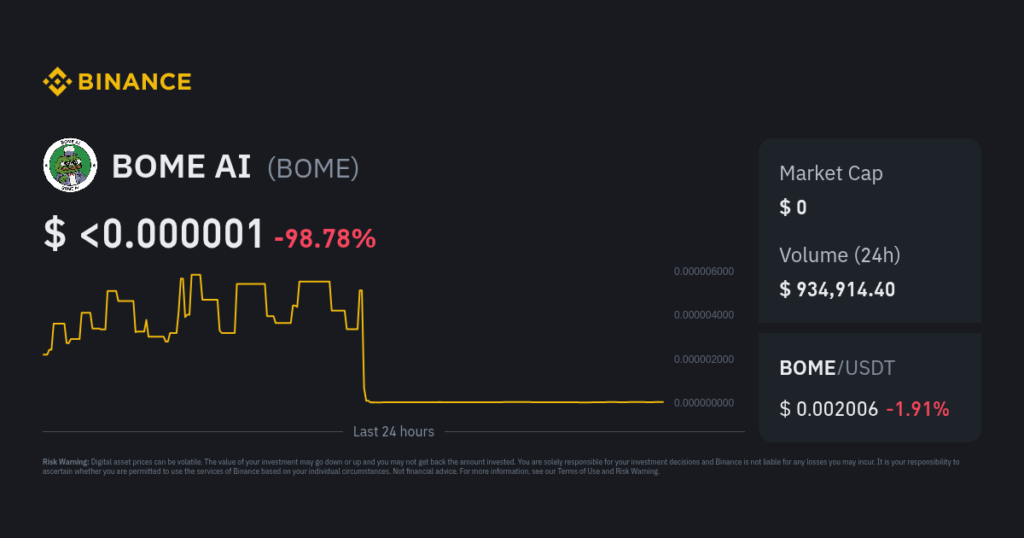

- Coin Name: BOME AI (also known as BOOK OF MEME or BOME 2.0)

- Current Price: ~$0.00201 USD per token (Coinbase)

- Market Cap & Supply:

- 24h Volume: ~$67 million (−23.4%) (Coinbase)

- Price Action: Down ~1.56% in 24h, up ~25% over 30 days, but down ~74.7% year-over-year (Coinbase)

BOME AI positions itself as a meme-culture token enhanced by AI-powered meme generation and analysis, deployed on BNB Smart Chain and Ethereum (CoinMarketCap, CoinGecko, CoinCodex).

2. 🔍 Technology & Use Case

- AI meme engine: BOME integrates AI to assist in meme creation, curation, and analysis, aiming to stay ahead in meme-trend traction (CoinMarketCap, CoinCodex).

- Blockchain backbone: Utilizes decentralized storage and smart contracts for immutable meme data tracking.

- Community engagement: Described as merging “meme culture with cutting-edge blockchain technology and artificial intelligence” (CoinMarketCap, CoinCodex).

Bottom line: Technically intriguing, but largely experimental. Its success will depend on sustained user engagement, AI effectiveness, and ecosystem growth beyond the initial hype.

3. 📈 Technical & On‑Chain Analysis

a. Momentum Indicators (BeInCrypto)

- RSI & MACD (Weekly): Bearish – RSI is well below neutral; MACD histogram negative (BeInCrypto).

- Moving averages: 50-week MA crossed below 200-week MA (bearish), and price trading below both (BeInCrypto).

b. Price trend context

- Spiked ~400% in past 24 h on some platforms (Coinbase/ Binance), but that reflects low liquidity and price noise—not sustainable real pump (Binance, Crypto.com).

c. Volatility & liquidity

- High daily volume (~$1 – 1.3 M) indicates speculative attention (Binance, Crypto.com).

- Circulating supply is large (68.9 B), making meaningful price jumps require major demand.

4. 🔮 Price Forecasts

Short-term

- Technicals suggest consolidation or downside (bearish weekly indicators).

- Watch major resistance around current ~$0.0021 and support near $0.0019.

Medium to long-term (DigitalCoinPrice)

Forecasts range from $0.000004 to $0.00001 over next 2–5 years—but these are speculative and based on past volatility (digitalcoinprice.com).

5. ✅ Pros & Risks

| ✅ Strengths | ⚠️ Risks / Weaknesses |

| Unique blending of AI & meme culture | Meme tokens are highly speculative |

| Strong daily volume (~$1 M) | Bearish on-chain sentiment |

| Large, engaged community bubbled by hype | Limited real-world utility |

| Integrates on multiple ecosystems | High supply dilutes value |

6. 🧭 Investment Outlook

- For traders: High volatility offers day-trading and swing-trading opportunities.

- For investors: Businesses looking for long-term value should see limited fundamental use-case beyond meme & tech experimentation.

- Key metrics to monitor:

- AI tool adoption metrics (active users, dApp engagement).

- On‑chain trends: new addresses, whale behavior.

- Tokenomics changes: burns, staking, utility partnerships.

7. 📌 Summary & Takeaway

- Current Price: ~$0.00201, with strong activity but $–74% year decline.

- Technicals: Bearish momentum; price range-bound.

- Fundamentals: Interesting concept but uncertain break beyond meme token status.

- Forecasts: Mixed, heavily speculative and uncertain.

- Outlook: Speculative bet. Best for high-risk traders; not yet proven as long-term value.

8. 🛠️ Tips & Strategy

- Define your goal: are you trading for short-term swings, or holding for potential AI-tech adoption?

- Risk management: high supply & volatility warrant small allocations.

- Watchchain indicators: monitor GitHub commits, telegram activity, protocol updates.

- Sharp triggers: new listings, real-world partnerships, or broader meme-market cycles.

📣 Conclusion

BOME AI (BOOK OF MEME) is at the crossroad of meme culture and AI intrigue—drawing speculative interest but lacking firm fundamentals. With bearish technicals and high supply, it carries significant risk. If you’re intrigued by its AI potential, allocate small amounts and track technical signals closely. Always base your moves on clear objectives and risk controls.